The AI revolution is unfolding right now – are you ready?

Thankfully, it’s a Technological Revolution – a period when one technology replaces others over a short period – rather than a Skynet/Terminator event.

From the ground-breaking launch and meteoric adoption of ChatGPT to Nvidia’s AI-powered stock rally in early 2024, AI is already transforming the way we work, play and live and in doing so, offers an investment opportunity with the companies driving its manufacturing, development and adoption, including some of the world’s largest technology blue chips.

In this blog, Global X dives into the world of AI, exploring the remarkable growth potential of this dynamic sector and unveils two new investment opportunities, one of which provides access to one of the world’s top AI strategies.

What is AI?

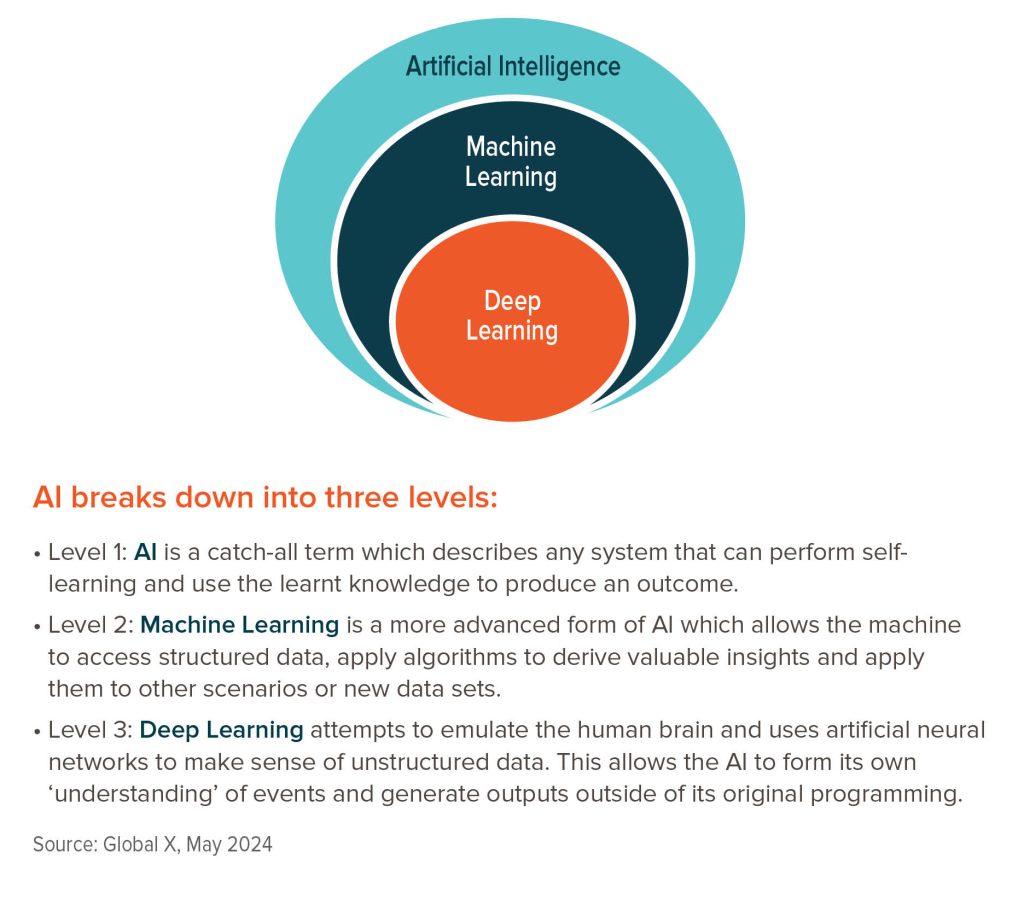

Artificial Intelligence (AI) is the simulation of human intelligence processing by machines. This includes various techniques such as machine learning, natural language processing and computer vision. Essentially, AI enables machines to learn from data, adapt to new inputs and perform tasks which typically require a human.

Diving Deeper into Deep Learning

Deep Learning takes AI a step further by copying the way the human brain works through the use of artificial neural network software. In an artificial neural network, each node provides a binary “yes/no” response to basic questions about a piece of data.

By layering many thousands or millions of these networks, a Deep Learning machine can generate reliable outputs (recommendations or interactions) without changing the underlying code. ChatGPT is an example of a Deep Learning system as it absorbs enormous amounts of information and then distils it to answer questions from users in a conversational way. A common theme across all three levels is that the power of AI comes from the availability of data. As digital data continues to accumulate, deep-learning models – with their ability to understand real-world, unstructured data – will likely grow at unprecedented rates. It is these models that currently represent the bulk of opportunities for AI across the economy.

AI’s Investment Potential & Financial Impact

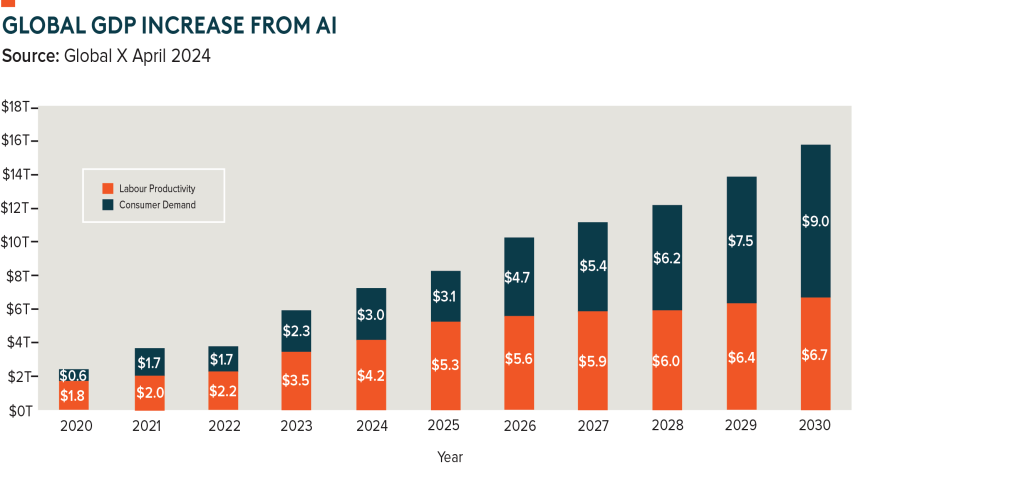

AI’s broad applicability represents a platform shift in the making, one that will have a broad influence on the adoption of technology across the economy. According to a PwC report, AI could contribute up to US$16 trillion to global GDP in 2030.

For context, that would equate to almost 14% of global GDP, more than the combined growth of China and India today.1

Over the last decade, computing rates have increased while the cost has decreased, meaning that AI can now be trained much more efficiently, enabling faster commercialization of AI products (Dennard’s Law in full effect).

This commercialization has seen AI spread to various sectors including Healthcare, Retail, and Banking which underscores the real-world demand for AI.

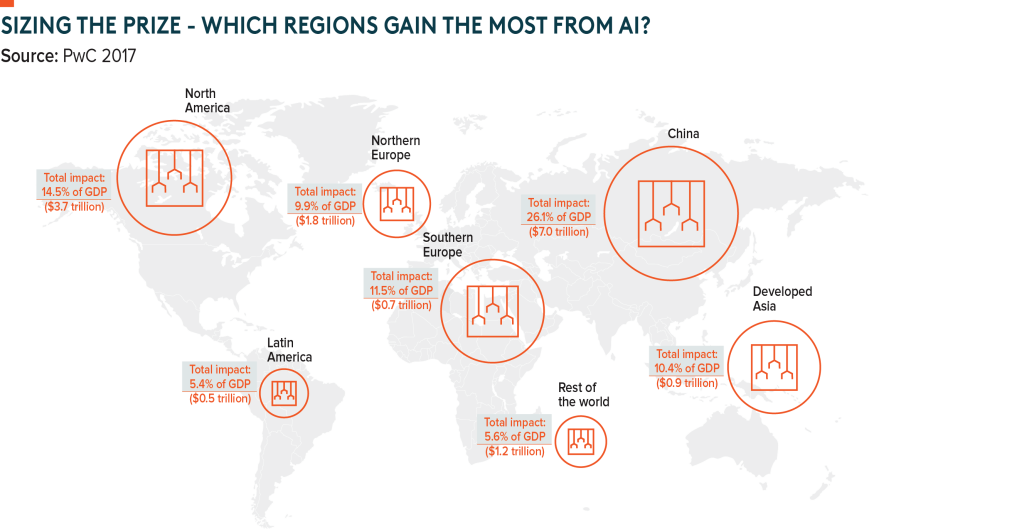

According to a study conducted by professional services firm PwC, AI could contribute $15.7 trillion to the global economy and increase GDP in local economies by up to 26% by 2030. PwC identified the economic impact of AI on the following global regions:

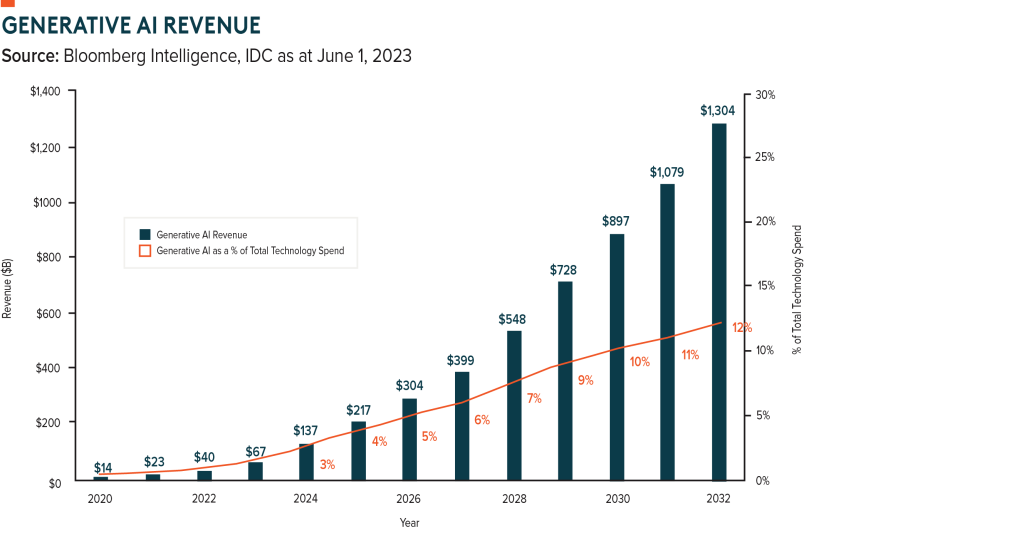

Investing in AI offers a compelling opportunity for long-term growth and innovation. The growth of investment into AI as evidenced by private equity investments and venture capital funding underscores the immense potential of this sector. In 2023, investments in generative AI by private equity firms reached $2.18 billion, according to an article from S&P Global Market Intelligence. Data from Bloomberg Intelligence shows that by the next decade, revenues from generative AI, which is AI that creates content with minimal human intervention, will top US$1.3 billion and makeup around 12% of net spend on tech.

Furthermore, studies project that AI could contribute trillions of dollars to the global economy and drive substantial increases in Gross Domestic Product by 2030, highlighting its significance as a driver of economic growth. The consensus among tech leaders and investors seems clear: investing in AI is essential for long-term product and financial success. As an example of this sentiment, in 2023, global private investment activity in AI more than doubled YoY while deal activity slumped across all sectors.

How Can I Invest in AI?

The timing has never been better to invest in AI. Investors who position themselves early in the AI space stand to benefit from the sector’s rapid growth and potential for disruptive innovation.

One way of taking part in the promising AI sector is through an exchange traded fund (ETF) which offers potential benefits such as diversification and lower risk when compared to individual stocks.

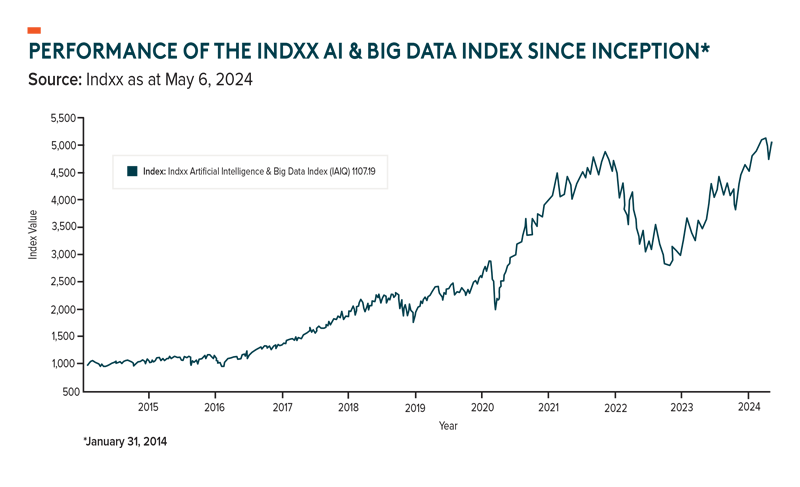

The Global X Artificial Intelligence & Technology Index ETF (AIGO) offers investors exposure to the AI value chain, providing access to companies at the forefront of AI innovation. AIGO seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Artificial Intelligence & Big Data Index. Although the fund has just launched, you can see the performance of its underlying index for illustrative purposes:

This index is designed to track the performance of companies that are positioned to benefit from the development and utilization of AI technology in their products and services, as well as companies that produce hardware used in Artificial Intelligence applied for the analysis of Big Data. The index intends to reflect the performance of companies engaged in applications of AI including but not limited to AI developers, AI-as-a-Service providers, AI hardware, and quantum computing.

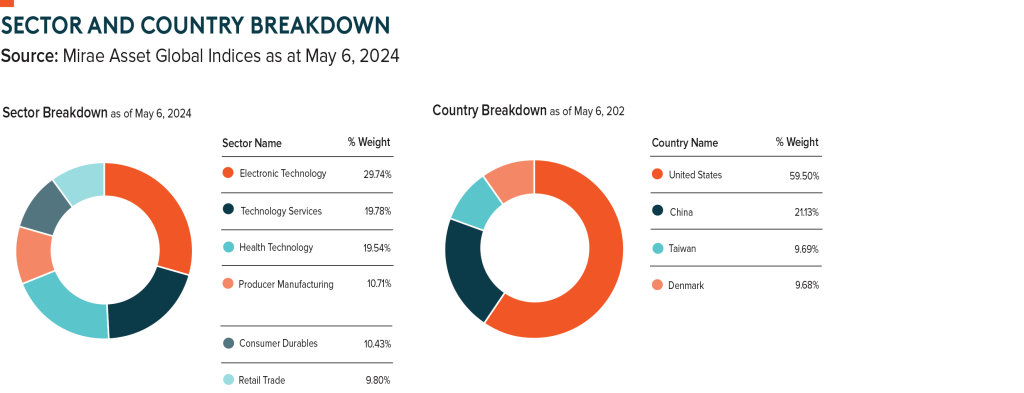

With a focus on companies involved in AI data analysis, service provision, and hardware production, AIGO aims to capture the full spectrum of AI-related opportunities. The fund’s unconstrained approach allows for diversified exposure to AI across sectors and geographies, positioning investors to capitalize on the sector’s exponential growth potential. Some reasons to consider AIGO:

- High Growth Potential: Spurred by breakthroughs in generative AI, Bloomberg forecasts suggest the global artificial intelligence market could increase more than 300x from $39bn in 2022 to $1.3tn by 2032.

- Rapid Commercialization: AI is quickly expanding beyond data centers, enabling innovative commercial applications in diverse sectors, including Agriculture, Health Care, and beyond. Bloomberg forecasts indicate that over 729 million individuals will use AI tools by 2030, up 254 million from 2023.

- Unconstrained Approach: Artificial intelligence spans multiple segments, and its most innovative companies include both household names and newcomers from around the world. AIGO allocates its investments across a variety of sectors and geographic regions.

AIGO includes AI enablers and adopters within its holdings. Enablers are companies developing foundational AI platforms such as cloud computing. These allow AI advancements through lower barriers of entry. Adopters are companies that use AI in their products and services. These are the companies at the forefront of AI to solve real-world problems and drive business value.

With AIGO, investors gain access to the forefront of AI innovation through diversification to capture growth opportunities. Consider AI the new frontier of innovation, with AIGO providing investors access to key companies driving its growth.

As the digital age progresses, investors looking to capitalize on innovation can consider exploring the opportunities offered by Global X Innovative Bluechip Top 10 Index ETF (TTTX).

For investors looking to strategically place themselves at the intersection of innovation and investment, TTTX offers a direct route into participating in the future of global technology. TTTX is not just an investment, but a stake in the transformative power of global innovation.

TTTX invests in a group of the largest publicly-listed companies leading the charge in sectors such as AI & Big Data, Semiconductors, Health Care and Biotechnology, and Next Generation Mobility including Batteries and Renewable Energy.

The focus on these sectors ensures that TTTX investors are positioned at the cutting edge of technological advancements. Global X wrote about two key elements of renewable energy here.

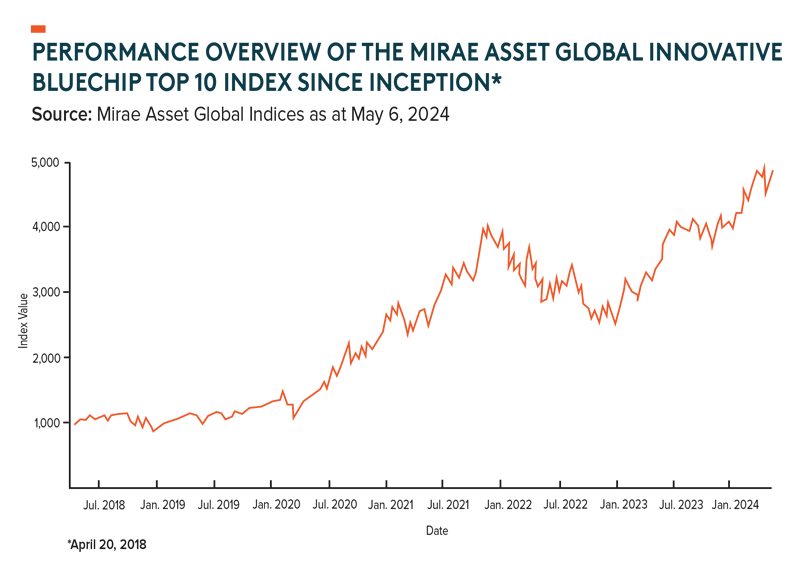

TTTX is engineered to replicate, as closely as possible and net of expenses, the performance of the Mirae Asset Global Innovative Bluechip Top 10 Index, which tracks the performance of global large-cap companies that consistently lead the growth of the industry based on their dominant positions across various sectors. The index has registered this level of performance since inception, shown here for illustrative purposes:

TTTX serves as a gateway to tech industry giants who are not just participating in, but driving innovation forward. Each constituent company is a significant player within its domain, exhibiting high operational profit margins, substantial cash flows, and strong returns on equity.

AI, Machine Learning, and Deep Learning have embedded themselves in everyday life and their use cases have steadily developed alongside the technologies which power them, presenting a compelling investment opportunity for the entire AI value chain. ETFs which capture this whole opportunity or hone in on a specific part of it can be an accessible way to gain exposure to AI.

With AIGO and TTTX, investors have the opportunity to capitalize on the transformative power of AI and position their portfolios for potential long-term success. By understanding the fundamentals of AI, exploring investment opportunities, and staying informed, investors can position themselves to thrive in the dynamic world of AI investing.

SOURCES:

1 Global X ETFs Australia with information derived from Bank of America (March 8, 2023) and the Me, Myself and AI Podcast (31 August, 2023).

DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

Indxx is a service mark of Indxx, LLC (“Indxx”) and may be licensed for use for certain purposes by Global X Investments Canada Inc. (“Global X” or the “Manager”). The ETFs are not sponsored, endorsed, sold, or promoted by Indxx. Indxx makes no representation or warranty, express or implied, to the owners of the ETFs or any member of the public regarding the advisability of investing in securities generally or in the ETFs particularly. Indxx has no obligation to take the needs of the Manager or the Unitholders of the ETFs into consideration in determining, composing, or calculating the Indxx Artificial Intelligence & Big Data Index. Indxx is not responsible for and has not participated in the determination of the timing, amount, or pricing of the Units to be issued or in the determination or calculation of the equation by which the Units are to be converted into cash. Indxx has no obligation or liability in connection with the administration, marketing, or trading of the ETFs.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Global X Investments Canada Inc. (“Global X”) is a wholly owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae Asset”), the Korea-based asset management entity of Mirae Asset Financial Group. Global X is a corporation existing under the laws of Canada and is the manager, investment manager and trustee of the Global X Funds.

Published May 15, 2024

Categories: Articles, Insights

Topics: A.I., Semiconductors, Technology