Introduction to the Semiconductor Industry

The semiconductor industry is a US$570 billion (Semiconductor Industry Association) market, which underlies our increasingly technologically-driven society. The development of semiconductors is a complex process made up of researchers, engineers, designers, and producers of semiconductor chips.

Semiconductor chips are all around us you could probably find at least 100 semiconductor chips within your own home as almost every electronic product contains them—including smartphones, laptops, televisions, gaming consoles, household appliances, vehicles, machinery, weaponry, and many other uses.

So, what exactly are semiconductors? In simple terms, semiconductors control and manage the flow of electricity in equipment and devices. Most semiconductors are composed of crystals made of several materials.

How are semiconductor chips made? Semiconductors require an extreme amount of precision to create them. They are essentially manufactured at an atomic level, which requires incredibly clean working environments, expensive facilities, and equipment. The process is arduous, with R&D and manufacturing costs making up the lion’s share of the cost structure for a semiconductor chip.

The life cycle stages for the semiconductor industry include the following stages:

The semiconductor industry is a US$570 billion (Semiconductor Industry Association) market, which underlies our increasingly technologically-driven society. The development of semiconductors is a complex process made up of researchers, engineers, designers, and producers of semiconductor chips.

Semiconductor chips are all around us you could probably find at least 100 semiconductor chips within your own home as almost every electronic product contains them—including smartphones, laptops, televisions, gaming consoles, household appliances, vehicles, machinery, weaponry, and many other uses.

So, what exactly are semiconductors? In simple terms, semiconductors control and manage the flow of electricity in equipment and devices. Most semiconductors are composed of crystals made of several materials.

How are semiconductor chips made? Semiconductors require an extreme amount of precision to create them. They are essentially manufactured at an atomic level, which requires incredibly clean working environments, expensive facilities, and equipment. The process is arduous, with R&D and manufacturing costs making up the lion’s share of the cost structure for a semiconductor chip.

The life cycle stages for the semiconductor industry include the following stages:

- Research. R&D is completed by companies or universities to increase the capability and performance of semiconductors.

- Design. Original equipment manufacturers (OEM) award design wins to chip vendors as they design the part into their system. Some companies are pure-play design companies, such as Advanced Micro Devices Inc. (AMD) and NVIDIA Corp.

- Fabrication/Foundry. Chips are manufactured in a complex process at this stage. There are some pure-play fabrication/foundry companies, however, there are also companies that participate in both designing and manufacturing, including TSMC, Intel, and Samsung.

- Testing/Packaging. This stage includes testing and packaging of chips as they are prepared to be brought to the end market. This includes companies such as Amkor and Tongfu Microelectronics.

The current state of the semiconductor market

An overlooked aspect of the semiconductor market is the interplay between geopolitics and economics. Industry fundamentals are largely driven by economic factors, however, the political tension off the shore of southeast China creates some investment risk.

Taiwan is an island nation that China claims it has ownership of, and happens to be the definitive leader in advanced semiconductor chip manufacturing capacity. The U.S. has maintained that it would defend Taiwan from any aggression made by mainland China on the island, however, the risk that a substantial portion of advanced semiconductor chip production falls into the hands of its economic rival has caused the U.S. to consider onshoring its chip production.

In August 2022, the U.S. supercharged its ability to design and manufacture semiconductor chips by signing into law: the U.S. CHIPS and Science Act—providing a whopping $280 billion of new funding to boost domestic research and manufacturing of semiconductors in the U.S.

Subsequently, in October 2022, the Biden administration published a set of export controls to cut China’s access to certain semiconductor chips in an attempt to slow the country’s technological and military advances.

The battle for semiconductor supremacy is well underway, and any geopolitical calamities could create supply shortages that could foster extreme pricing swings and market shifts.

The investment thesis for Semiconductors

The semiconductor industry can be characterized by one word: cyclicality. This means that the sector goes through cycles of mismatched supply-demand fundamentals.

In a downturn, demand dries up leading to an oversupply of chips. Inventories build, and prices fall as new capacity additions by foundries are curbed.

Eventually, the downturn ends in an upturn as limited capacity additions lead to underwhelming supply growth. Demand will ultimately outpace constrained supply and lead to a shortage of chips, rising prices, and longer lead times.

Global Semiconductor Revenues

Overall, the long-term growth of the semiconductor industry is underpinned by the demand for electronics. Computing, communications, and consumer electronics are all fast-growing end markets that rely on a greater amount of semiconductor production. The driving force of the next wave of technologies includes areas such as AI, quantum computing, and robotics—all of which require a substantial amount of semiconductor supply.

How to invest in the Semiconductor industry?

For Canadians to gain investment exposure to the growing semiconductor industry, look no further than Global X Semiconductor Index ETF (CHPS) (formerly Horizons Global Semiconductor Index ETF).

CHPS tracks the Solactive Capped Global Semiconductor Index at a modest 0.55% management expense ratio as at December 31, 2022 while paying out an almost 1.0% annualized distribution yield.

The ETF came to market in June 2021 and has assets under management (AUM) of $51.5 million as at May 30, 2023.

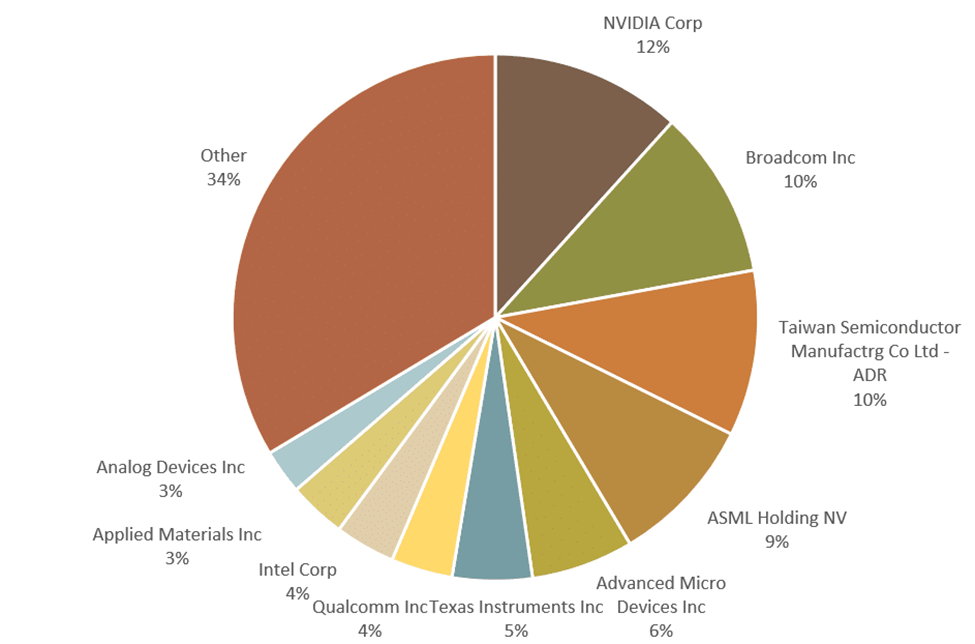

CHPS is well diversified within the semiconductor space, holding a range of designer and fabrication companies across different geographies. Its top ten holdings* are:

- NVIDIA Corp

- Broadcom Inc

- Taiwan Semiconductor Manufacturing Co Ltd – ADR

- ASML Holding NV

- Advanced Micro Devices Inc

- Texas Instruments Inc

- Qualcomm Inc

- Intel Corp

- Applied Materials Inc

- Analog Devices Inc

*As at May 26, 2023

Top Holdings in CHPS

DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

The financial instrument is not sponsored, promoted, sold, or supported in any other manner by Solactive AG nor does Solactive AG offer any express or implicit guarantee or assurance either with regard to the results of using the Index and/or Index trade name or the Index Price at any time or in any other respect. The Index is calculated and published by Solactive AG. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the Issuer, Solactive AG has no obligation to point out errors in the Index to third parties including but not limited to investors and/or financial intermediaries of the financial instrument. Neither publication of the Index by Solactive AG nor the licensing of the Index or Index trade name for the purpose of use in connection with the financial instrument constitutes a recommendation by Solactive AG to invest capital in said financial instrument nor does it in any way represent an assurance or opinion of Solactive AG with regard to any investment in this financial instrument.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Published June 1, 2023

Categories: Articles, Insights

Topics: Semiconductors, Technology