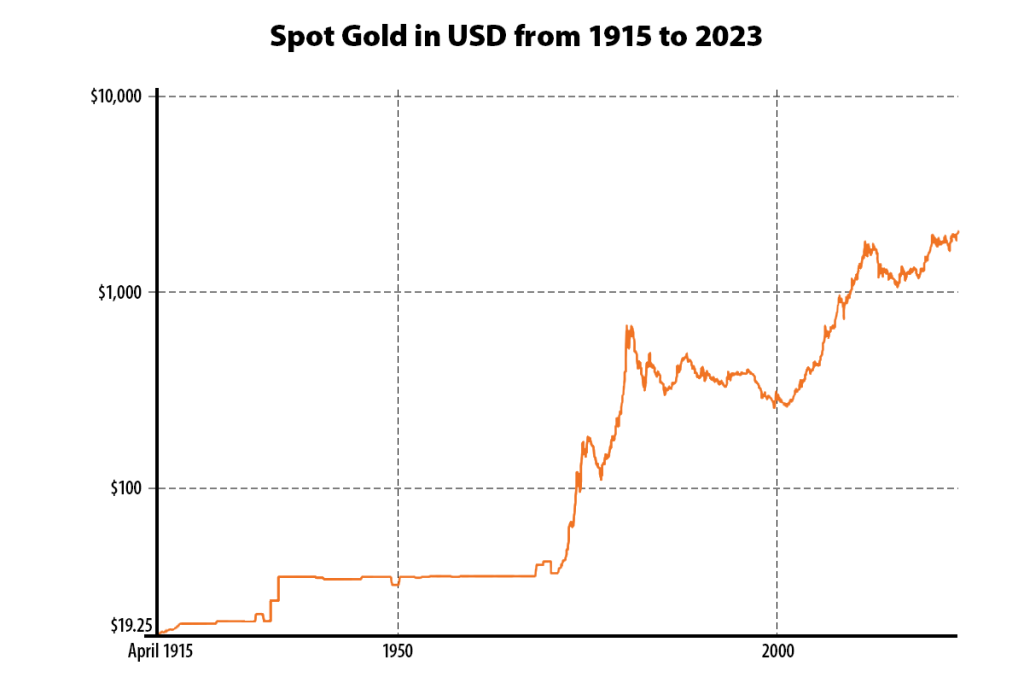

The price of gold hit a new record high in December of 2023 and has risen 13% over the year.

What’s in store for 2024? We’ll take a look at some questions that we’ve heard from investors about gold, dive into some of the underlying drivers for its pricing and explore some ways to invest in the precious commodity.

Gold By the Numbers

| 49% | Around half of all gold that is mined today is made into jewellery – the precious metal’s single largest use. |

| 50 miles | Gold is so ductile, that one ounce can be stretched as far as 50 miles. |

| 11.2 million | If all the gold in the world was pulled into a 5-micron thick wire, it would wrap around the globe 11.2 million times. |

THE IMPORTANCE OF GOLD

For thousands of years, gold has been used as a form of currency to enable transactions. Societies used gold coins because gold had its intrinsic value. Minting gold also helped control the supply of money and prevented governments from issuing too much currency. Traditionally, the role of gold in many cultures was to act as the store of wealth. Indeed, in several countries around the world not only is gold a status symbol, it is an integral part of cultural rituals such as marriage.

WHAT MAKES GOLD SO ATTRACTIVE?

One of the main attractions of gold is its limited supply. All of the gold that has ever been produced in human history can fit into at least three Olympic-size swimming pools. To underline gold’s global scarcity, the long-term average of production has been approximately 2% per year of the outstanding gold that has already been mined. This means that every year, only an additional 2% is added to those three Olympic-sized pools.

WHAT’S DRIVING THE PRICE OF GOLD?

There are multiple different drivers for the price of gold, including the supply of U.S. dollars as well as the geopolitical and financial stability risks. These drivers have different impacts on the price of gold at different times.

During the height of the COVID-19 pandemic, the U.S. government and Federal Reserve (Fed) combined to increase the supply of money by 40% over 18 months, reducing the value of previously printed U.S. dollars, which helped to support a higher gold price. In a media interview in early 2024, Fed Chair Jerome Powell said that the U.S. is currently on an unsustainable fiscal path in the long term.

Over the past two years, there has been an increase in geopolitical uncertainty including the Russia-Ukraine war and conflict in the Middle East, which are also helping to support a higher gold price.

Some global central banks and investors are also buying gold to hedge against any possibility of long-term financial instability such as a U.S. regional banking crisis of early 2023, which increased the risk of financial instability and helped to support a higher gold price. All of these reasons have led to gold hitting an all-time high in December 2023 in U.S. dollars.

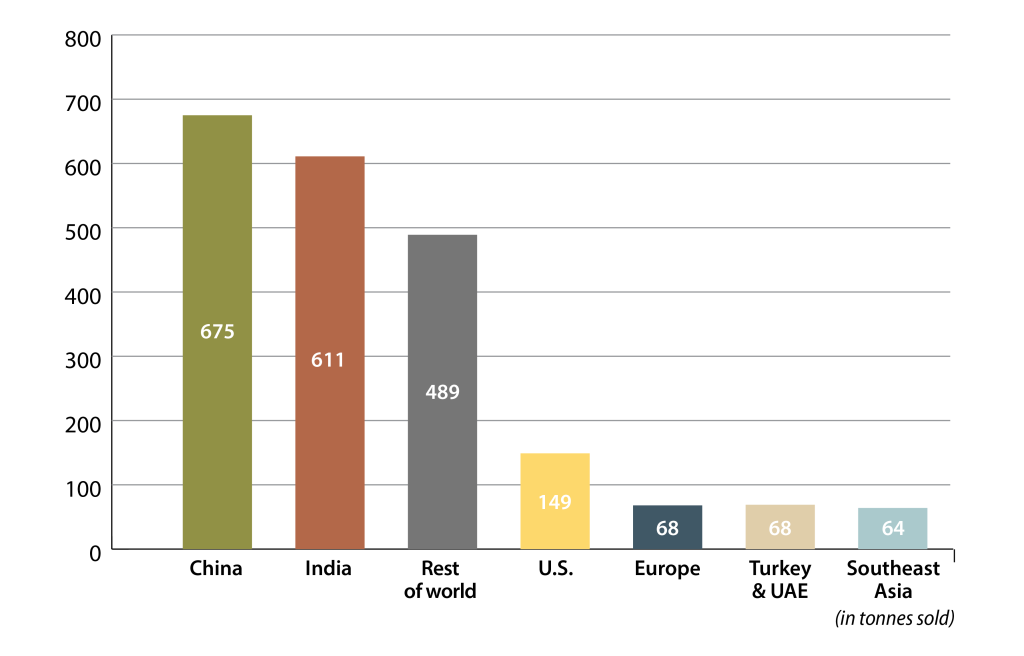

WHO HAS BEEN BUYING UP GOLD?

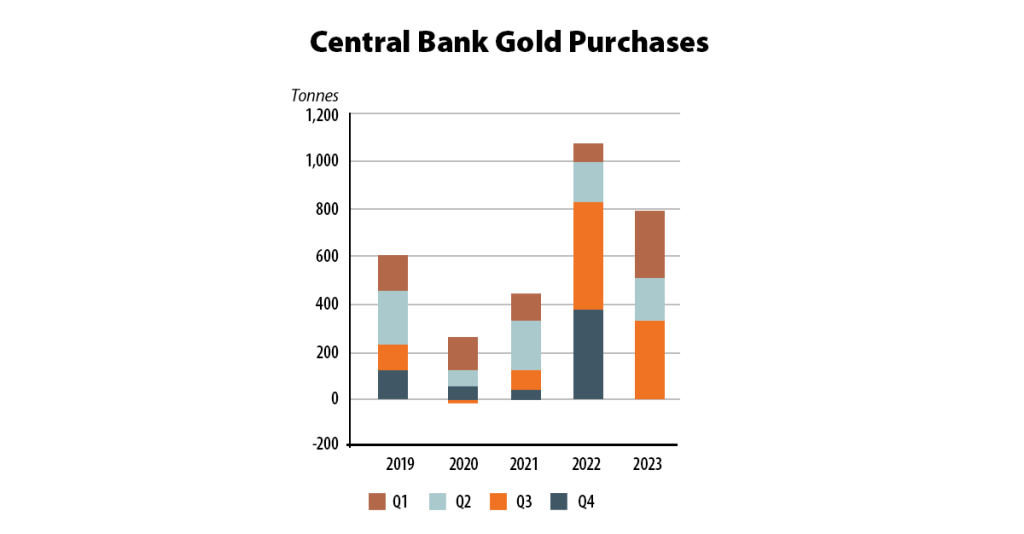

Central banks around the world added 1,037 tonnes of gold to their reserves last year, almost matching 2022’s record of 1,082 tonnes.1 Below, you can see just how much gold has been purchased by these government institutions over the past five years in the following chart:

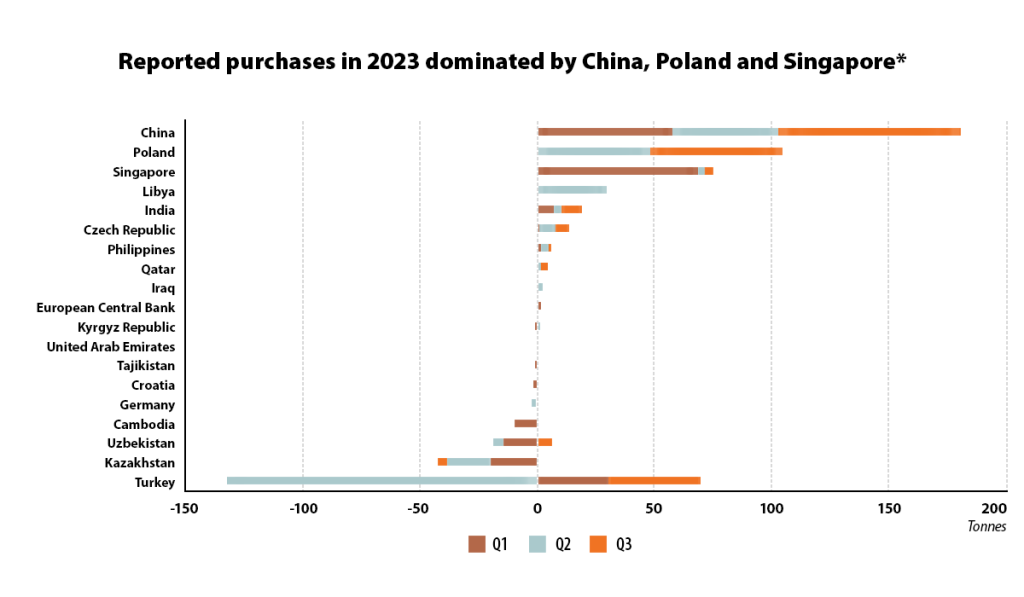

Of the world’s central banks, it appears in the graph below, that non-Western central banks have been buying the largest amounts of gold. This could be part of a trend of foreign governments using less U.S. dollars for transactions as they look for other forms of settling trade and storing wealth, both of which have increased the attraction of gold.

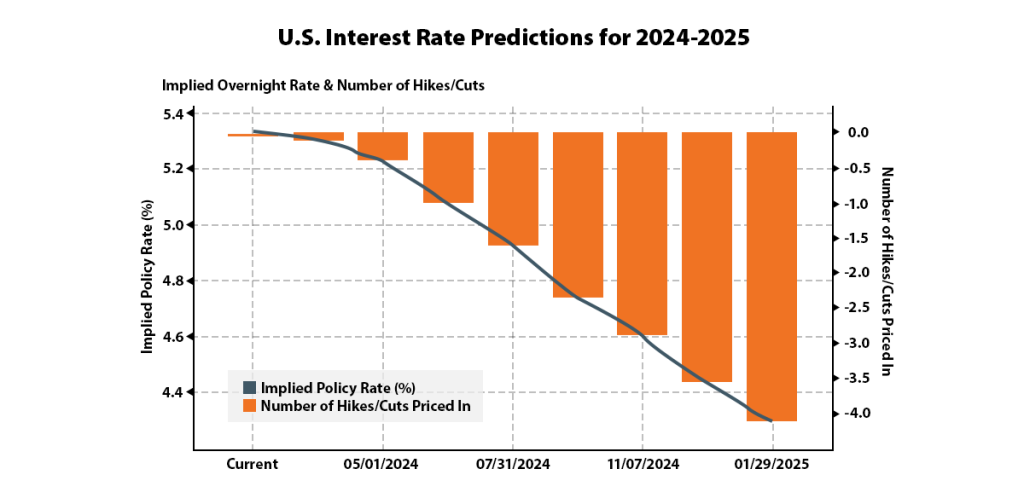

In 2024, gold has shown signs of stability as investors are anticipating that the Fed will cut its federal funds rate later in the year.

OUTLOOK

We know that gold touched a new all-time high late last year. But where is the price headed?

Researchers at one J.P. Morgan estimate that gold could potentially peak around the US$2,300 per ounce mark in 2025. That’s assuming the Fed cuts rates by 125 basis points in the second half of the year to avoid a recession as some economists think the growth in the U.S. economy could slow to 0.5% in the second quarter of 2024. Central banks are also likely to continue their bullion-buying spree in 2024, with the Wall Street bank researchers estimating that 950 tonnes of gold will be bought this year.

WAYS TO INVEST IN GOLD

There are different ways of investing to potentially benefit from the movement in the price of gold. Investors can invest in physical gold itself or by buying individual gold mining stocks.

Alternatively, investors can consider a gold-focused investment vehicle, including exchange traded funds (ETFs).

ETF investing can offer potentially greater diversification than holding individual stocks. This can help reduce the risks associated with investing in just one or two companies.

Global X Investments Canada Inc. (“Global X”) offers solutions that can help investors gain exposure to gold as a commodity and its producers.

One of them is the Global X Gold ETF (formerly Horizons Gold ETF), which tracks the price movement of gold bullion. It trades under the ticker symbol HUG.

For those interested in the potential of the companies mining gold – rather than the underlying commodity itself – consider the Global X Gold Producer Equity Covered Call ETF (formerly Horizons Gold Producer Equity Covered Call ETF), which offers a covered call approach to investing in gold producers. This ETF trades under the ticker symbol GLCC.

SOURCES

1 State Street Global Advisors/The World Gold Council, “Talking Gold – February 2024”.

DISCLAIMERS

Commissions, management fees, and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain Global X Funds may have exposure to leveraged investment techniques that magnify gains and losses which may result in greater volatility in value and could be subject to aggressive investment risk and price volatility risk. Such risks are described in the prospectus. The Global X money market funds are not covered by the Canada Deposit Insurance Corporation, the Federal Deposit Insurance Corporation, or any other government deposit insurer. There can be no assurances that the money market fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the Funds will be returned to you. Past performance may not be repeated. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Published February 20, 2024

Categories: Articles, Insights

Topics: Commodities, Gold