Short-term government-backed Treasury Bills (T-Bills) historically tend to have different credit risk dynamics than other types of short-term fixed-income vehicles.

Credit quality as a whole can be difficult to navigate – and is one of the major hurdles in deciphering the risk level of fixed-income vehicles.

While a group of fixed-income ETFs or mutual funds can have the same investment grade rating, they may not necessarily carry the same risk profile. In our view, nowhere is this more the case than when comparing government-backed bonds to investment-grade corporate credit or aggregate bond strategies with corporate credit.

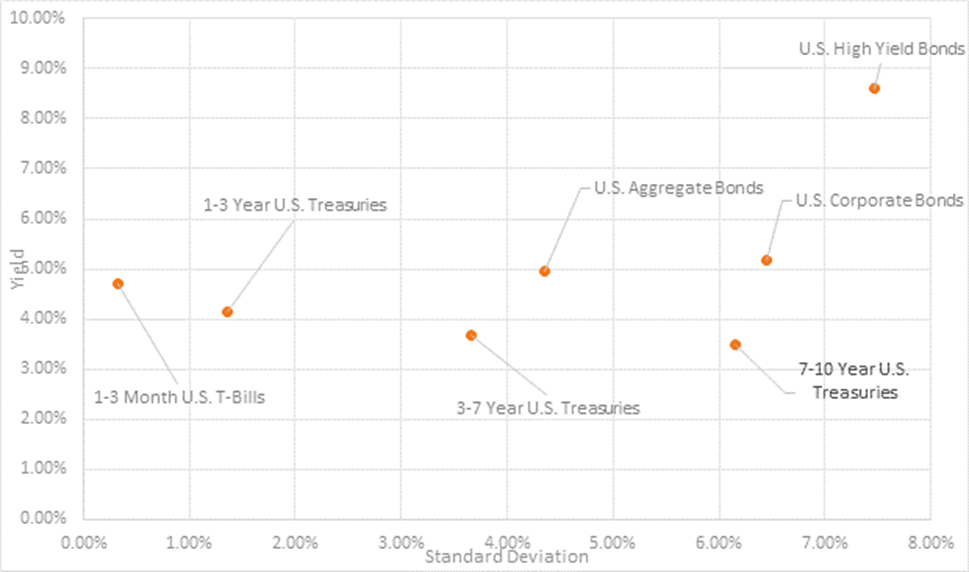

With the launch of the Global X 0-3 Month T-Bill ETF (CBIL) and the Global X 0-3 Month U.S. T-Bill ETF (UBIL.U), (formerly Horizons 0-3 Month T-Bill ETF and Horizons 0-3 Month U.S. T-Bill ETF respectively) we have opened up an area within the ultra-low risk end of the fixed-income spectrum that many Canadian investors are likely not familiar with. Below is the risk/yield profile of existing fixed-income benchmarks. High-yield bonds have not historically been a feature of the Canadian fixed-income landscape; therefore, we use the U.S. benchmark in the chart below for illustrative purposes.

Figure 1: Fixed Income Benchmark Risk/Yield Profile

Apart from the high-yield benchmark, during present market conditions, the band on yields for most of the benchmarks will typically be narrow – roughly between 4% and 6%. However, the standard deviation of these benchmarks is quite different. This divergence is a function of the extreme nature of the inverted yield curve, where investors may not be mathematically compensated for the risk of owning longer-duration or lower credit quality.

There may be many options for investment-grade bond solutions with similar maturities and yields that are available for investors. However, it doesn’t mean they are interchangeable or offer comparable risk. To better understand the current potential benefits of ultra-short T-Bills in a fixed-income portfolio relative to other short-term fixed-income strategies, let’s take a look at a few factors:

- Drawdown Risk: Arguably, T-Bills could be the most important risk offset in a fixed-income portfolio. When there is a full-on crisis in the capital markets, credit moves correlate more with equities. Similarly, the rapid rise of interest rates in 2022 and the carnage it created in longer-duration fixed income are well documented. Generally, you can see that the short-term category of ETFs with interest rate protection preserved significant capital, relative to the broad investment grade benchmark.

- Duration beyond 6 months offers little return vs. risk: Within the short-end of the yield curve – 0 to 3 years – there’s currently not a lot of value in any type of strategy with a duration of over 1 year, particularly when looking to maximize risk return. The yields on a short-term fixed-income ETF strategy that provides exposure to corporate credit are not likely to compensate investors for taking the potential extra risk to even be outside of 6 months’ duration.

- Investors are not being compensated for credit risk: Corporate bond spreads have tightened quite a bit in the last month. In particular, U.S. corporate bond spreads for investment-grade corporate debt are only about 132 basis points above the equivalent Treasury rate, as at April 14, 2023. This spread tends to tighten even more on shorter-term debt. As we’ve seen with standard deviation and drawdowns, this is likely not a great risk/reward trade-off. T-Bills are backed by the full faith and credit of their government issuer, which means that credit risk is a minimal factor for them.

T-Bill ETFs such as CBIL and UBIL.U may currently offer an attractive trade-off compared to other fixed-income strategies. They offer both a potentially improved credit risk and duration profile versus other fixed-income strategies which currently have much longer durations. Historically, the risk-reward trade-off of owning ultra-short fixed T-Bills was not as attractive given their extremely low yield (near zero at times). That’s not the case anymore with much higher policy interest rates.

CBIL and UBIL.U can work effectively as anchors in a fixed-income portfolio. These strategies currently provide attractive yield and very little risk, freeing capital for investors to utilize higher sources of yield, potentially from equities or other types of fixed income in a barbell strategy.

The key: the risk of the entire fixed income portfolio is potentially improved by owning CBIL and UBIL.U. Market conditions can change, which could result in additional benefits in owning longer-duration bonds and higher credit risk strategies. Our tagline for CBIL and UBIL.U is “Safety + Income”; these two ETFs are new options in the Canadian fixed-income space that we believe make a valid case for providing both features.

DISCLAIMERS

Commissions, management fees, and expenses all may be associated with an investment in products (the “Global X Funds”) managed by Global X Investments Canada Inc. The Global X Funds are not guaranteed, their values change frequently and past performance may not be repeated. The Global X money market funds are not covered by the Canada Deposit Insurance Corporation, the Federal Deposit Insurance Corporation, or any other government deposit insurer. There can be no assurances that the money market fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the Funds will be returned to you. Past performance may not be repeated. The prospectus contains important detailed information about the Global X Funds. Please read the relevant prospectus before investing.

CBIL & UBIL.U may be susceptible to an increased risk of loss, including losses due to adverse events because fund assets are concentrated in a particular issue, issuer or issuers, country, market segment, or asset class. While U.S. Treasury and Canadian Treasury obligations are fully backed by the respective governments, such securities are nonetheless subject to credit risk (i.e. the risk that the issuing government may be, or be perceived to be, unable or unwilling to honour its financial obligations, such as making payments). For a full description of the associated risks, please refer to the fund’s prospectus at www.GlobalX.ca.

Certain statements may constitute a forward-looking statement, including those identified by the expression “expect” and similar expressions (including grammatical variations thereof). The forward-looking statements are not historical facts but reflect the author’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. These and other factors should be considered carefully and readers should not place undue reliance on such forward-looking statements. These forward-looking statements are made as of the date hereof and the authors do not undertake to update any forward-looking statement that is contained herein, whether as a result of new information, future events or otherwise, unless required by applicable law.

This communication is intended for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase investment products (the “Global X Funds”) managed by Global X Investments Canada Inc. and is not, and should not be construed as, investment, tax, legal or accounting advice, and should not be relied upon in that regard. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. These investments may not be suitable to the circumstances of an investor.

All comments, opinions and views expressed are generally based on information available as of the date of publication and should not be considered as advice to purchase or to sell mentioned securities. Before making any investment decision, please consult your investment advisor or advisors.

Published May 25, 2023

Categories: Articles, Insights

Topics: Income, Money Market